Statewide Economic Indicators

Below is the University of Oregon State of Oregon Economic Indicators for November 2020. The release date is January 12, 2021. Special thanks to our sponsor, KeyBank

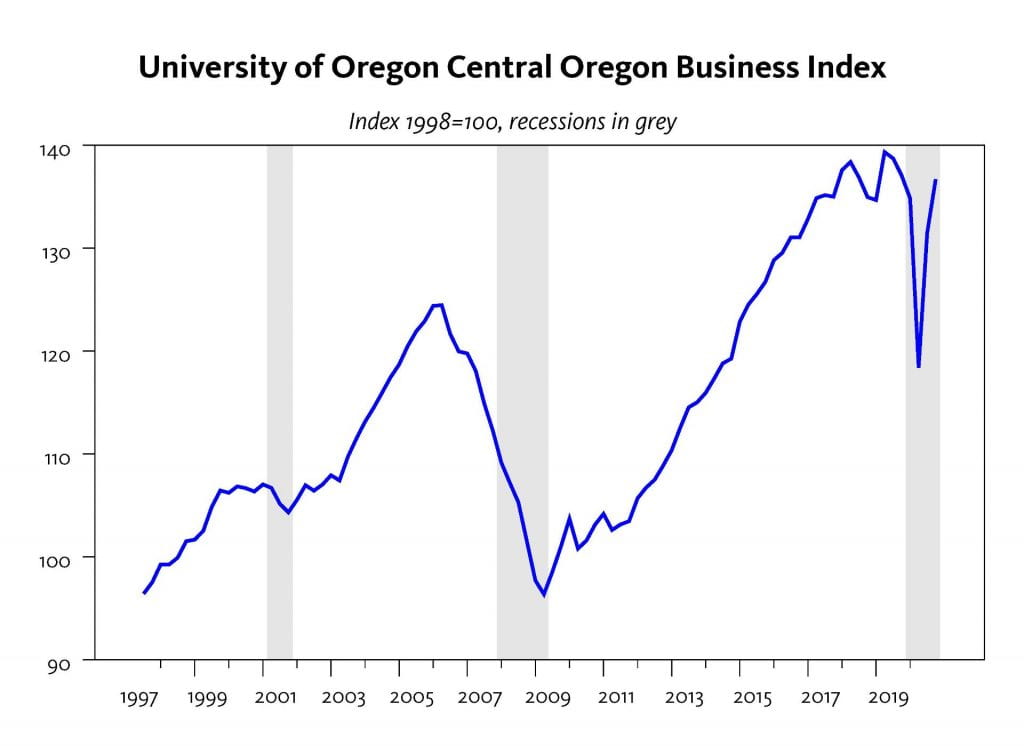

Link to full report (with charts!) here.

The Oregon Measure of Economic Activity fell to -0.07 in November from an upwardly revised 0.80 in October. The moving average measure, which smooths out the volatility, was 0.22, above average but low relative to past economic expansions.

Highlights of the report include:

- The largest components weighing down the measure were construction employment and initial jobless claims. Construction employment has been volatile in recent months; last month this component made a large positive contribution and the general trend of construction employment is up.

- The University of Oregon Index of Economic Indicators fell 1.1% in November after a 2% gain in October.

- Interestingly, initial unemployment claims were up sharply due to additional measures to contain the pandemic but employment services (largely temporary help) workers rose. This suggests that while firms impacted by the new restrictions contracted employment there was some compensating demand in other sectors.

- Housing units permitted has drifted lower overall but single-family permits have risen; the single-family market is experiencing robust demand. Core capital good manufacturing orders rose again and are well-above pre-pandemic levels.

- The economy entered the fourth quarter with solid momentum that was soon dampened by the winter wave of the pandemic. So far, however, the damage is considerably less than that experienced last spring as fewer firms are directly impacted. The rollout of Covid-19 vaccines supports an optimistic medium-term outlook but the pandemic is a headwind for the economy in the near-term.

Media Contacts:

Tim Duy – 541.346.4660 (w)