The April 2015 Oregon Regional Economic Indexes of was released today. Full report is available here. We thank KeyBank for their generous support of this project.

Measures of activity softened during the spring, but still indicate that all areas are growing at or above their average pace of activity. Highlights of the report include:

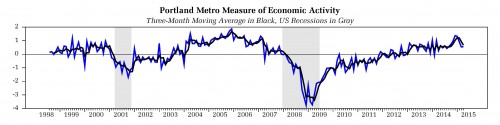

- Moving average measures of activity – which smooth monthly volatility – indicate that all areas are growing at or above their average pace of activity. Recall that “zero” for these measures indicates relative average growth; each region has its own underlying growth rate.

- The civilian labor force component drove weakness across all areas, particularly in Eugene-Springfield and the Rogue Valley. The labor force typically grows during Oregon expansions, but instead has trended downward in recent months. The decline may simply reflect unusual variability in the data rather than a fundamental shift in labor force trends. If not, we would expect to see growth curtailed as firms struggle to fill positions.

- Portland’s measure was largely unchanged from March. The volatile construction and financial employment components weighed on the measure, which nonetheless continues to signal above average growth.

- Historically low levels of housing permits continue to weigh on the Eugene-Springfield, Salem, and Rogue Valley measures. Still, the Eugene-Springfield and Salem measures remain in the above average growth range, albeit somewhat weaker than prior to the 2007-9 recession.

- The below-average reading in the Rogue Valley is due in large part to the labor force data. As noted earlier, it would be premature to be overly concerned at this point as it may reflect data variability. The moving average measure for the region suggests average growth.

Reminder: The regional measures are prone to potentially large swings due to the volatility of some of the underlying data, particularly measures of employment. The moving average measures smooth out much of that volatility.