Please stay safe as our state struggles with this historic wildfire season.

Economic Forum

We are once again partnering with the SEDCOR in Salem for a virtual Economic Forum next week. I hope you can join me and Oregon’s state economist Mark McMullen as we dissect the national and state economies next week, September 16th at noon. Registration is free (although donations are welcome!). To register, please visit:

https://us02web.zoom.us/webinar/register/WN_6eUuq-XHQ-G0Da7Akth5lw

We look forward to being able to return to in-person events after the Covid-19 pandemic ends.

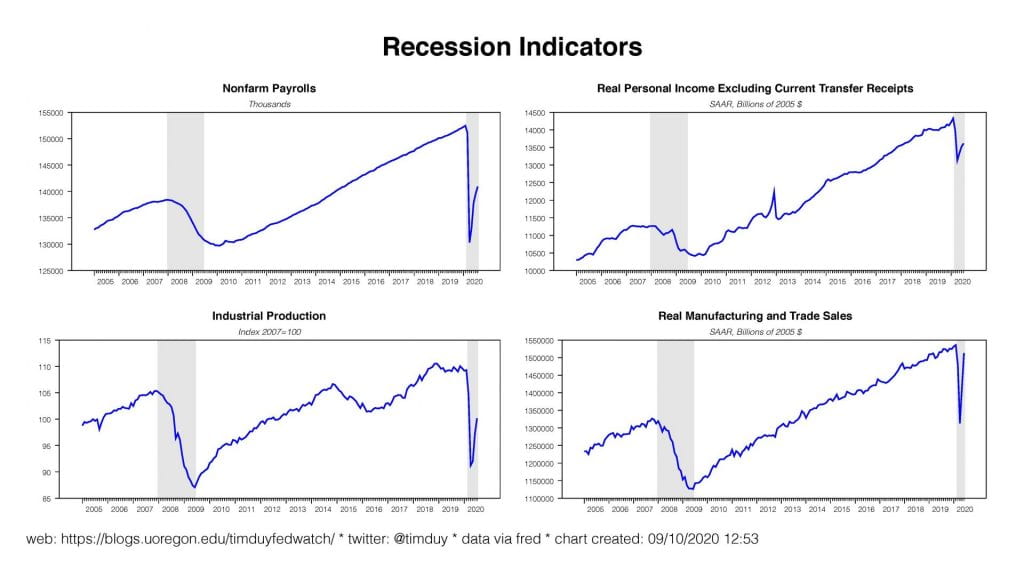

Monthly Recession Dating Indicators

Statewide Economic Indicators

Below is the University of Oregon State of Oregon Economic Indicators for July 2020. The release date is September 10, 2020. Special thanks to our sponsor, KeyBank

Link to full report (with charts!) here.

The improvement in the UO economic indicators suggest the end of the technical recession is in sight although the pace of the subsequent recovery remains in question.

Highlights of the report include:

- The Oregon Measure of Economic Activity fell in July to 0.14 from 2.01 in June. The moving average measure, which smooths out the volatility, now stands at 0.79, or above average growth in Oregon. That said, only the services sector contributed positively to the measure as employment components continued to improve. Employment components weighed down the manufacturing and construction sectors.

- The University of Oregon Index of Economic Indicators gained 1.5% in July, extending the improvement in June. Though still elevated, initial unemployment claims continue to fall while employment services payrolls, mostly temporary help workers, climbed higher.

- Residential housing permits and the Oregon weight-miles tax, a measure of trucking activity, remain remarkably steady given the depth of the recession while new orders for core-manufacturing goods have rebounded to just shy of their pre-pandemic levels.

- Consumer sentiment, however, remains weak as would be expected given elevated levels of unemployment.

- Substantial improvement in the UO Index typically signals that a recession will soon end; just as the recession began quickly in the wake of widespread business shutdowns, it will likely end quickly. In fact, the recession might technically have already ended with the surge of growth anticipated for the third quarter of this year. In addition, typical monthly recession dating indicators have all turned what appears to be sustainably higher.

- The pace of the recovery, however, is still expected to slow as some sectors, particularly leisure and hospitality, remain negatively impacted by the Covid-19 pandemic.

Media Contacts:

Tim Duy – 541.346.4660 (w)