Consumer price inflation eased back from the January spike, silencing concerns that inflation would soon make a comeback. This will help keep the Fed focused on its gradual tightening path. If they want to shift gears, they will have to look elsewhere.

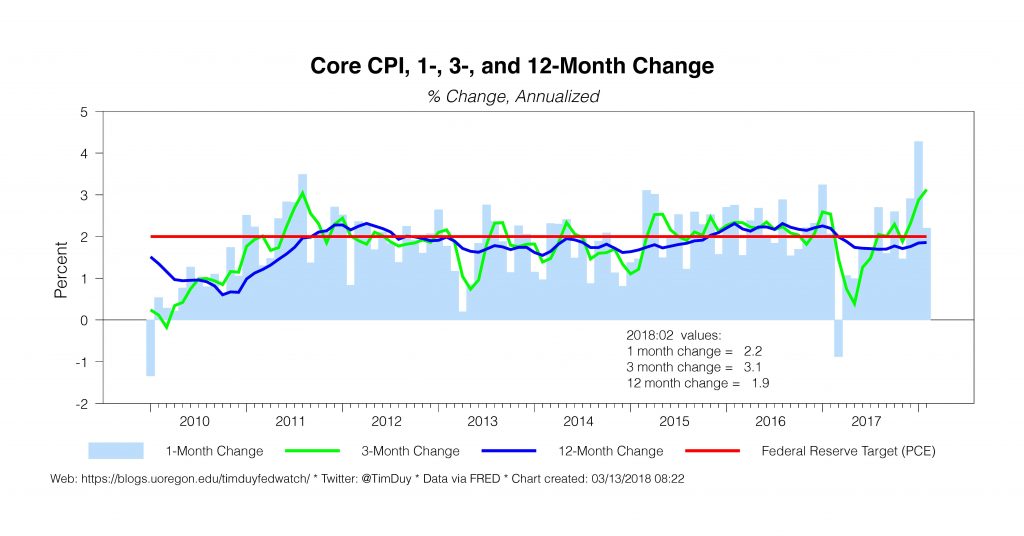

Core CPI decelerated in February to 0.2 percent month-over-month, compared to a 0.3 percent gain the previous month. The annualize monthly gain was 2.2 percent. Be wary of reading too much into the three-month gain of 3.1 percent as that will quickly come down if the monthly readings stay low.

It is worth considering that the stronger December and January numbers reflected some unaccounted for seasonal factors. Given the low inflation environment, the numbers of times firms change prices during the year decreases, and the timing of those changes are concentrated around the beginning of the year (a natural time to change prices). If so, then the December and January numbers were largely transitory.

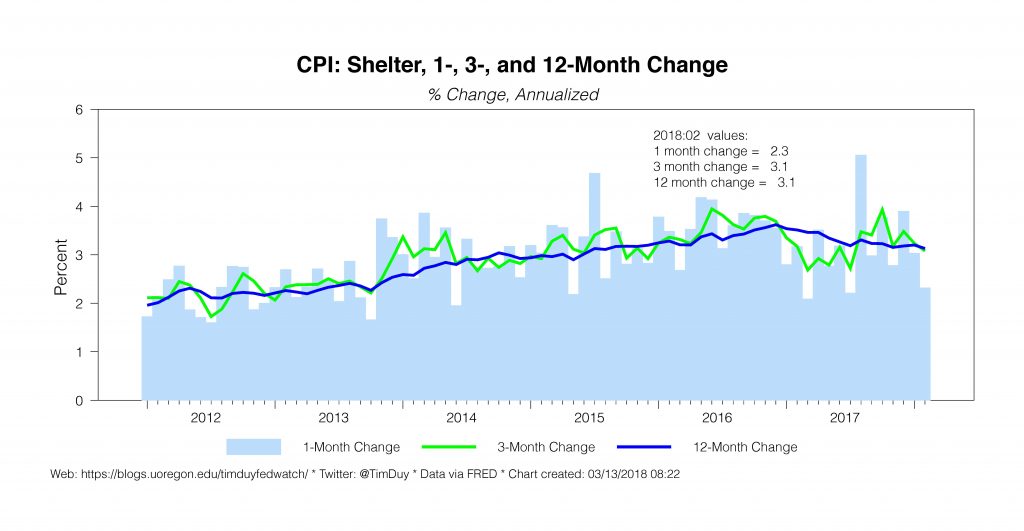

Two additional points in this quick post. First, with multifamily housing starts holding strong, gradually declining shelter inflation will likely continue to weigh on overall inflation. Second, PCE inflation, the Fed’s actual inflation target, traditionally runs roughly 50bp below core. So a 2.2 percent core CPI inflation implies something like 1.8 percent core PCE inflation. That is still weak relative to the Fed’s two percent inflation target.

Bottom Line: Inflation numbers help confirm the Fed’s current forecast, but don’t signal any overshooting of their target yet. The Fed hence can’t yet place an accelerated pace of rate hikes on the back of actual inflation. Changes in the rate forecast instead remain attributable to risk management considerations as tailwinds threatens to push the economy into overheating that would reveal itself in either excessive inflation or financial instability.