A few items for you consideration this morning:

1.) My column at Bloomberg from last week:

The Federal Reserve has taken unprecedented steps in recent weeks to cushion the U.S. economy from the effects of the expanding coronavirus pandemic, including slashing its benchmark interest rate back to zero and eliciting the usual cries that the central bank is “out of ammunition.” Nothing could be further from the truth.

Continued here…

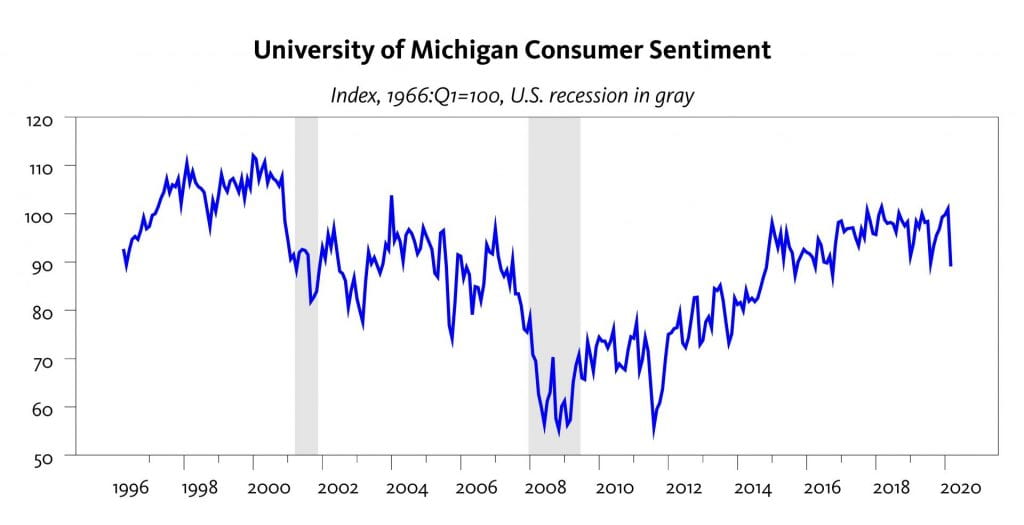

2.) Consumer confidence tumbled in March, but remained within its recent range:

Expect further declines in April as the unemployment rate climbs higher.

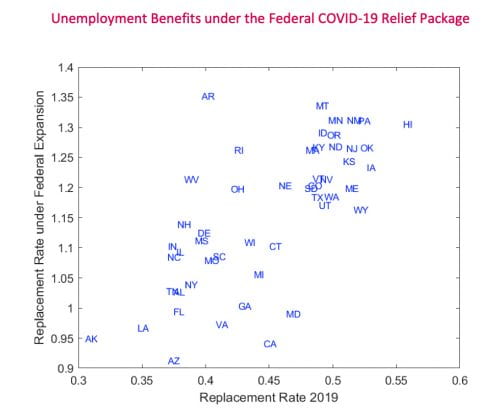

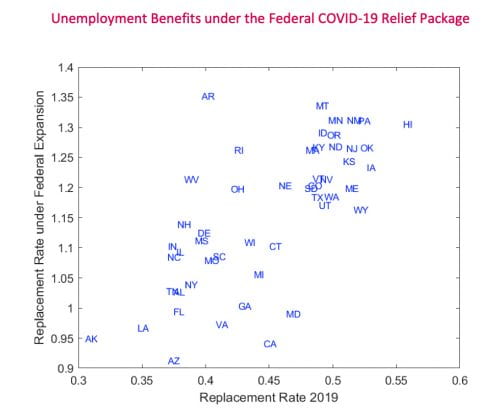

3.) Speaking of unemployment, last week the CARES (Coronavirus Aid, Relief, and Economic Security) Act was signed into law. The act provides for enhanced unemployment benefits of $600/week for up to 4 months on top of state benefits and includes the expansion of benefits to “gig workers.” The additional benefits will push the average replacement income for eligible workers in Oregon about 100%:

This is very substantial support for unemployed workers and should help cushion the economy during this “sudden stop” of economic activity. For more information of state-by-state comparisons, see this report from the University of Wisconsin (source of above chart).

4.) The CARES Act also provides support for small- and medium-sized firms. Of particular importance is the Paycheck Protection Program which provides forgivable loans to cover payroll costs (excluding costs for any compensation above $100,000 annually), mortgage interest, rent payments and utility payments. The loans do not require a personal guarantee or collateral. The hope is to have these loans available as early as this week. Like enhanced unemployment insurance, this is the type of program that, if utilized quickly, can help firms stay afloat and preserve the basic structure of the economy. More more information, see this from the U.S. Chamber of Commerce.

5.) For helping to plan when we might see the other side of this crisis, see this helpful report from the American Enterprise Institute: National coronavirus response: A road map to reopening.

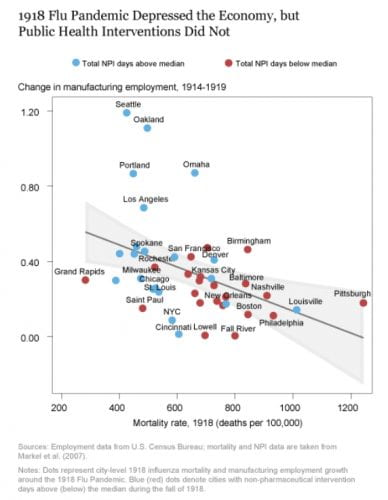

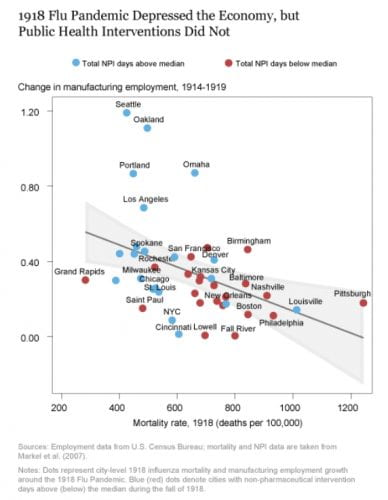

6.) On the academic side, see this report from the New York Federal Reserve on the benefits of early and aggressive action to contain pandemics:

Our paper yields two main insights. First, we find that areas that were more severely affected by the 1918 Flu Pandemic saw a sharp and persistent decline in real economic activity. Second, we find that cities that implemented early and extensive NPIs suffered no adverse economic effects over the medium term. On the contrary, cities that intervened earlier and more aggressively experienced a relative increase in real economic activity after the pandemic subsided. Altogether, our findings suggest that pandemics can have substantial economic costs, and NPIs can lead to both better economic outcomes and lower mortality rates.

7.) Finally, please stay safe! We are seeing distressing reports that the deaths attributable to the novel coronavirus in China may be far higher than originally reported. From Bloomberg:

The long lines and stacks of ash urns greeting family members of the dead at funeral homes in Wuhan are spurring questions about the true scale of coronavirus casualties at the epicenter of the outbreak, renewing pressure on a Chinese government struggling to control its containment narrative.