Good morning! Thank you for subscribing to these reports, and special thanks to KeyBank for sponsoring our work.

An inability to get updated data has delayed the latest release of the Regional Economics Indicators; the Oregon Statewide continues to be released regularly with an update coming this week.

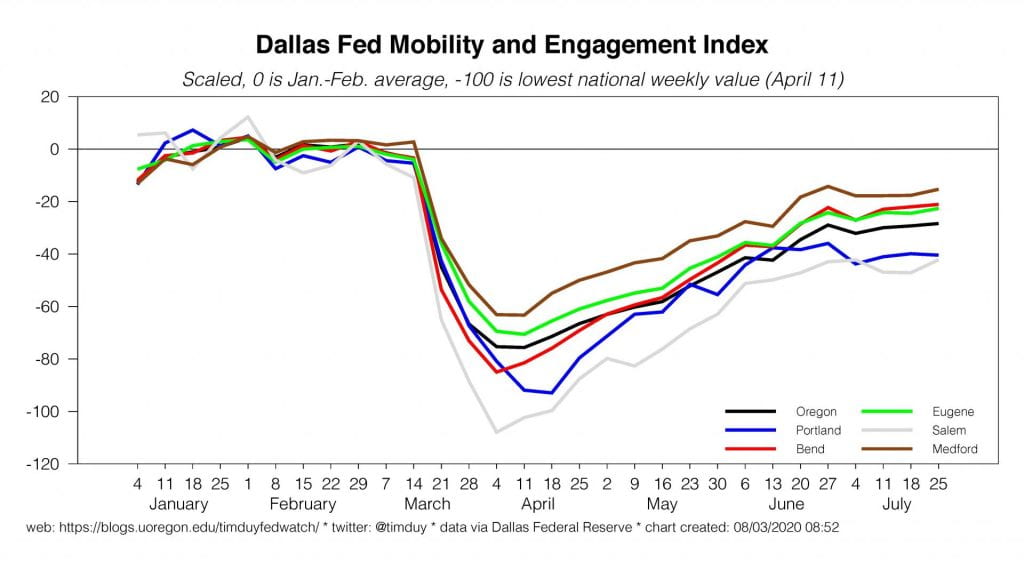

While I wait for the delayed data, I want to share some insights gained from the Dallas Federal Reserve Mobility and Engagement Index (MEI). The MEI uses mobile device data to track the extent to which people are traveling aways from their homes. The greater the mobility, the more likely that people are engaged in more normal types of economic activity. The MEI is scaled such that 0 is the average of January and February and -100 is the lowest level of mobility (April 11) for the nation. More details in the MEI’s construction can be found here.

The data is available by state, county, and metropolitan service area. For Oregon and it’s major metropolitan areas, the data reveals a fairly wide dispersion of mobility and engagement outcomes but all share the similar pattern of leveling off in the latter half of June and July:

The Medford area has retained the most mobility and engagement with a July 25 reading of -15.3. This compares with the Portland and Salem areas with values of -40.3 and -42.2, respectively. Bend and Eugene are also similar to each other at -21.1 and -22.6, respectively.

There are two broad takeaways from these data. The first is that the recovery is progressing more slowly in Salem and Portland compared to other parts of the state. Note that the Multnomah, Washington, and Clackamas are still in Phase 1 status and the proximity of these regions to Marion County may impact activity there as well. This would explain the relativeness weakness of the Portland and Salem areas. The remaining areas are all in Phase 2 of reopening.

The second takeaway is that the pace of improvement in all areas has either slowed or leveled off in recent weeks. The trend has been evident in other areas of the nation as Covid-19 cases have climbed; where either due to renewed business closures (such as that ordered for Umatilla County) or increased caution on the part of individuals, we see less mobility and likely less economic activity.

More generally, mobility and engagement is not likely to return to its pre-pandemic levels until we have greater containment of the virus or an effective therapy or vaccine. Until that time, some parts of the economy, in particular leisure and hospitality, can’t yet fully recover and thus there will be a limit to the extent of the overall recovery.